6 Beauty Salon Loan Options To Fund Your Business

Finding the best beauty salon loan can feel overwhelming. Get the inside scoop on the different funding options in this helpful guide.

Finding the best beauty salon loan can feel overwhelming. Get the inside scoop on the different funding options in this helpful guide.

Salon owners have unique financial needs that many lenders just don’t understand. But some innovative finance, tech, and beauty companies now offer lending solutions tailor-made for professionals like you.

With the right beauty salon loan, you can access the working capital you need to turn your “Dream Beauty Salon” Pinterest board into a reality – without throwing everything on your business credit card.

Here’s what to look for when picking a loan, which works best for a beauty business, and what benefits you’ll enjoy from each type.

[CTA_MODULE]

What Is a Beauty Salon Loan?

Special loans exist just for small businesses like yours, and many of them are especially well-suited for beauty salons. Whether you’re just starting out or looking to upgrade your space, tools, or services, a loan can provide the funds you need to reach your goals.

A beauty salon loan isn’t necessarily a single type of product (with one exception, which we’ll get into in a minute). It’s more of a category – a type of funding that banks and lenders offer because they understand that salons have unique expenses. Professional-grade hair dryers? Stylish decor that shows clients you have an eye for beauty? Those aren’t run-of-the-mill business expenses, but they’re essential for building the salon you want.

Loans can also help with bigger investments – like expanding to new locations, growing your team, or introducing the latest treatments and services. During slower seasons, a business loan can even provide the financial cushion you need to stay on top of day-to-day expenses.

How To Choose the Right Loan for Your Beauty Salon

It’s easy to get overwhelmed when looking for a way to borrow money. Here are a few steps you should take to choose the best loan for your beauty salon:

- Define the purpose: Know exactly what you’ll use the funds for. New salon equipment? A remodel? Extra staffing? Understanding your needs helps you determine the right loan type and amount.

- Compare terms: Interest rates, fees, and repayment schedules vary widely across loans. Crunch the numbers to find the most cost-effective fit.

- Check qualifications: Each lender has eligibility criteria based on factors like credit score, revenue, and time in business. Check the requirements first so you don’t waste time or risk dinging your credit by applying for a loan you won’t qualify for.

- Vet the lender: Look for lenders with a strong reputation for customer service – ideally one known for being flexible when hardships come up. You don’t want to end up paying ultra-high interest later.

- Evaluate the loan disbursement speed: In a rush? Prioritize lenders who provide quicker application decisions and fast access to funds.

The 6 Best Types of Beauty Salon Loans

Now that you’re armed with some important background information, it’s time to learn about the different types of beauty salon loans and the benefits they offer.

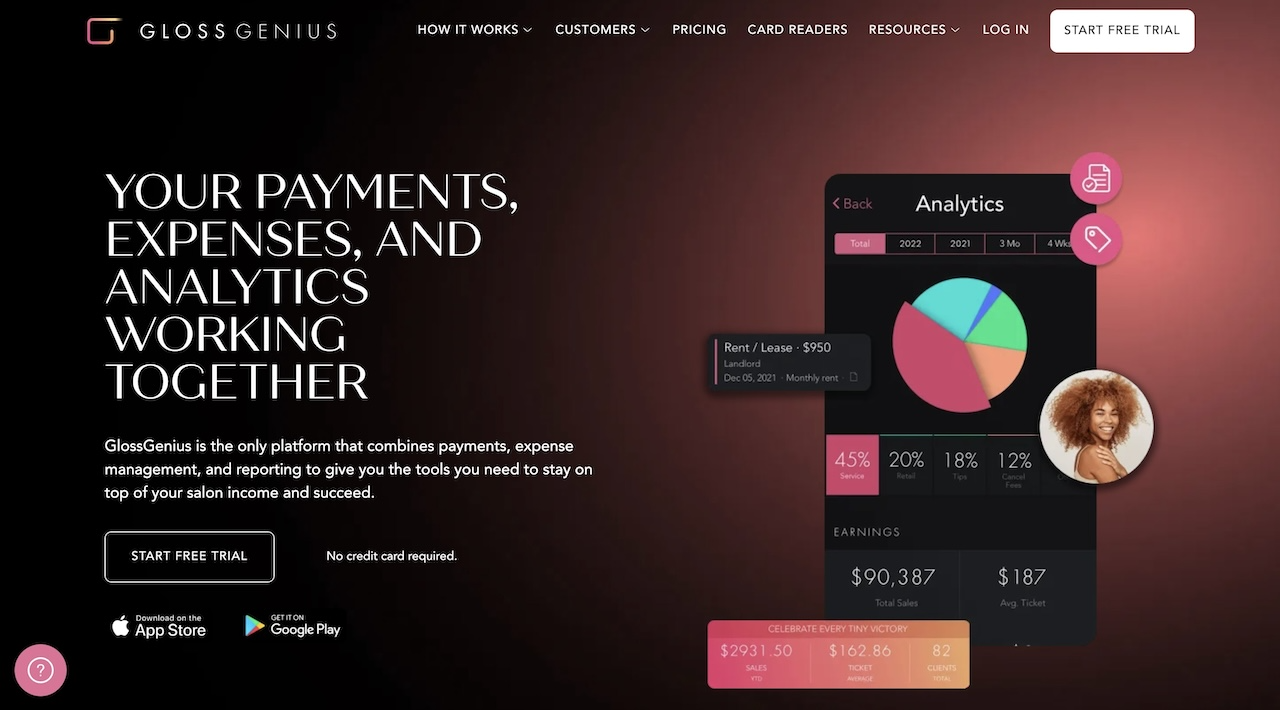

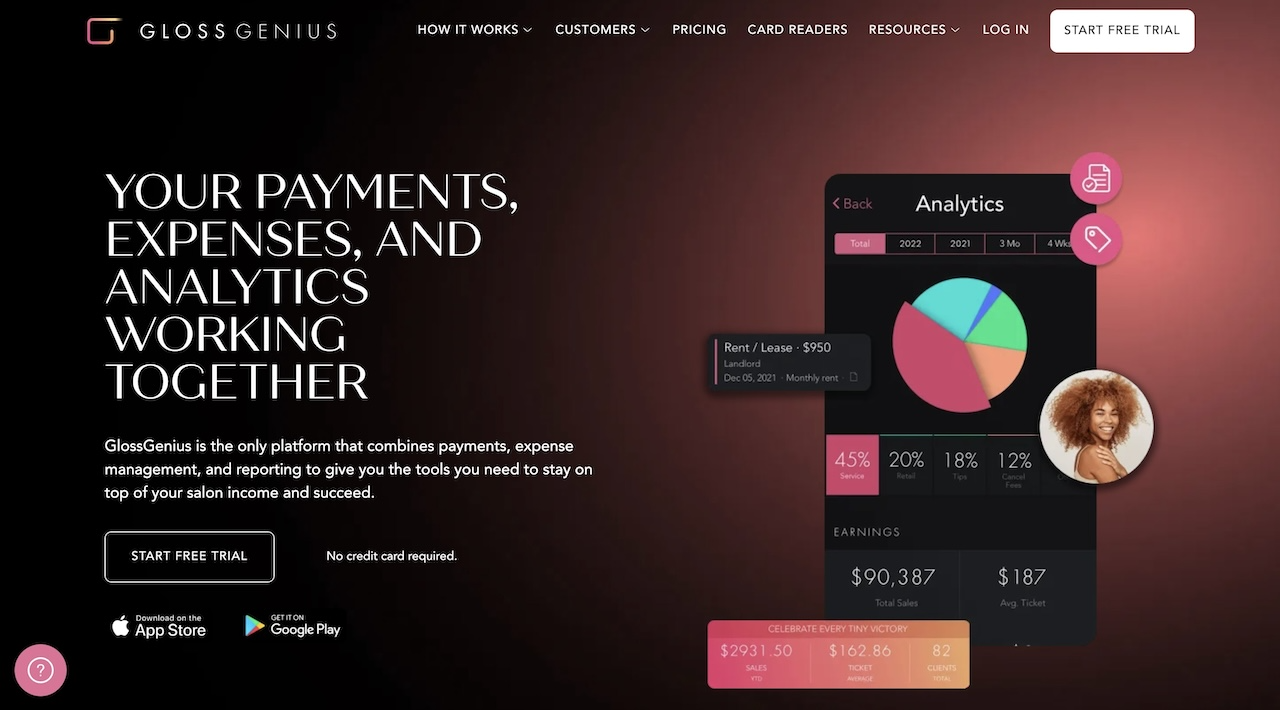

1. GlossGenius Financing

GlossGenius Financing can help small salon and spa businesses reach their goals. Financing offers range from $1,000 to $250,000 USD, with funds available in as little as two business days if approved.

Try GlossGenius free for 14 days!

What makes GlossGenius Financing special? You just need to be a GlossGenius customer to qualify and process payments with GlossGenius for at least 90 days. And once the financing has been funded, your monthly payment adapts based on salon revenue*. Slower sales cause your payment to go down, which makes staying current on the financing a lot more manageable.

Benefits of Genius Loans

- Fast funding (within two business days)

- No impact to your personal credit rating

- Eligibility based on your GlossGenius payment history

- Pay toward your financing automatically based on your sales*

- Simple fee structure with no compounding interest, collateral, or late fees

2. Small Business Administration Loans

The SBA 7(a) loan program from the Small Business Administration (SBA) gives beauty salons flexible financing options for different needs. Working capital loan? Equipment loan? Funding to invest in real estate? The SBA helps you do it all.

SBA Microloans offer small business loans up to $50,000, making them a great fit for salon owners needing modest capital to purchase equipment or expand services. If you need quick access to funds, SBA Express Loans provide faster approval times so you can act quickly on new opportunities.

Since SBA loans are guaranteed by the government, the rules to qualify are easier than traditional bank loans. That makes this type of funding perfect for salon owners looking to refresh their space, hire more stylists, or take whatever other steps they need to grow.

Getting a loan backed by Uncle Sam means your approval odds go up. You may also get lower interest rates and perks compared to alternatives.

Benefits of SBA Loans

- Can be used for real estate, working capital, or salon equipment financing

- Easier qualifications than traditional loans

- More favorable terms thanks to backing from the government

- Capable of supporting various salon growth and sustainability projects

3. Traditional Bank Loans

Banking has become so digitized that walking into your local branch might feel like stepping back in time. But a traditional bank loan could be just the thing you need to help your business flourish. And don’t let the word “bank” throw you – many credit unions offer small business loans too.

Loans from traditional banks and credit unions typically include options like:

- Commercial real estate loans for purchasing or renovating a salon space

- Business lines of credit to manage cash flow or cover unexpected expenses

- Equipment loans for buying salon tools and equipment

- Construction loans to build or expand your salon

- Refinancing options for consolidating higher-interest debts like business credit card balances or merchant cash advances into a single, lower-interest loan

Benefits of Traditional Bank Loans

- Competitive interest rates and flexible terms

- A variety of loan options to suit different needs

- Local market expertise from experienced lenders

- Support for both growth initiatives and operational costs

4. National Funding Loans

National Funding is a small business funding company that provides customized financing solutions for beauty and wellness businesses. Its lending options – which include small business loans and equipment leasing – aim to help salons and spas cover operating expenses, make payroll, upgrade equipment, and manage staff.

Benefits of National Funding Loans

- Financial services tailored to the beauty and wellness industry

- Options for equipment financing and small business loans

- Quick and easy application process

- Personalized lending solutions based on the specific needs of beauty businesses

5. Merchant Cash Advances

Merchant cash advances (MCAs) provide salon owners with financing based on future sales instead of upfront collateral. You can usually get them from banks or private funding companies. You just pay a fixed percentage of your salon’s daily revenue until the balance is repaid.

The MCA application process focuses on sales trends rather than personal credit scores, making MCAs an accessible option for businesses with less-than-perfect credit. Having your payments tied to a percentage of daily sales could also prove helpful during slower periods.

But proceed with caution – MCAs come with a high cost. Annualized interest rates can range from 30% to 60% or more, which is far above the traditional financing options tied to the prime rate. While MCAs provide quick access to funds, the repayment structure can strain cash flow and create a cycle of dependency if you’re not careful. Avoid this option unless you have strong, predictable sales and a clear plan for managing repayment.

Benefits of Merchant Cash Advances

- Fast access to funds

- Flexible payments

- No upfront collateral required

- Simple application process

GlossGenius now offers MCAs in addition to traditional business loans for all GlossGenius members.

6. Personal Loans for Business

[CTA_MODULE]

Some salon owners use assets like their home or 401(k) account to secure a personal loan, which they then use to self-fund initial startup costs or smaller expansion projects.

Taking on personal debt is riskier and lacks conventional business loan protections. You won’t lose your house if you default on an SBA loan, for example. But if you put up your home as collateral for a personal loan and then fail to pay, the consequences could be life-changing – and not in the good way.

For well-qualified applicants, personal loans can act as short-term financing options for targeted expenses until revenue stabilizes. Just make sure you have a very solid plan in place to repay.

Benefits of Personal Loans

- Not tied to the business

- Flexible depending on your personal assets

Finance Your Beauty Salon With GlossGenius

Ready to launch your salon or give your existing business a boost? Sign up for a 14-day free trial of GlossGenius, the all-in-one salon management platform designed to help you handle scheduling, client records, and business operations without major upfront costs.

Try GlossGenius free for 14 days!

GlossGenius offers easy financing features, with an affordable monthly payment model that makes our salon software accessible to beauty professionals and teams of all sizes. And once you’ve built up a payment history with GlossGenius, it’s super easy to get the fast, flexible financing that will help your business grow.

Stripe Capital offers financing types that include loans and merchant cash advances. All financing applications are subject to review prior to approval. In the US, Stripe Capital loans are issued by Celtic Bank and YouLend provides Stripe Capital merchant cash advances.

*Stripe Capital loans have a minimum amount due each payment period, and if the minimum amount that you pay through sales doesn’t meet the minimum your account will be automatically debited the remaining amount at the end of the period. If your loan has a fixed payment, Stripe stops withholding from your Stripe sales when you meet the fixed payment amount. The payment terms for your offer will be detailed during the application process.

.png)

.png)

Join Our Genius Newsletter

Get the latest articles, inspiring how-to’s, and educational workbooks delivered to your inbox.

6 Beauty Salon Loan Options To Fund Your Business

Finding the best beauty salon loan can feel overwhelming. Get the inside scoop on the different funding options in this helpful guide.

Salon owners have unique financial needs that many lenders just don’t understand. But some innovative finance, tech, and beauty companies now offer lending solutions tailor-made for professionals like you.

With the right beauty salon loan, you can access the working capital you need to turn your “Dream Beauty Salon” Pinterest board into a reality – without throwing everything on your business credit card.

Here’s what to look for when picking a loan, which works best for a beauty business, and what benefits you’ll enjoy from each type.

[CTA_MODULE]

What Is a Beauty Salon Loan?

Special loans exist just for small businesses like yours, and many of them are especially well-suited for beauty salons. Whether you’re just starting out or looking to upgrade your space, tools, or services, a loan can provide the funds you need to reach your goals.

A beauty salon loan isn’t necessarily a single type of product (with one exception, which we’ll get into in a minute). It’s more of a category – a type of funding that banks and lenders offer because they understand that salons have unique expenses. Professional-grade hair dryers? Stylish decor that shows clients you have an eye for beauty? Those aren’t run-of-the-mill business expenses, but they’re essential for building the salon you want.

Loans can also help with bigger investments – like expanding to new locations, growing your team, or introducing the latest treatments and services. During slower seasons, a business loan can even provide the financial cushion you need to stay on top of day-to-day expenses.

How To Choose the Right Loan for Your Beauty Salon

It’s easy to get overwhelmed when looking for a way to borrow money. Here are a few steps you should take to choose the best loan for your beauty salon:

- Define the purpose: Know exactly what you’ll use the funds for. New salon equipment? A remodel? Extra staffing? Understanding your needs helps you determine the right loan type and amount.

- Compare terms: Interest rates, fees, and repayment schedules vary widely across loans. Crunch the numbers to find the most cost-effective fit.

- Check qualifications: Each lender has eligibility criteria based on factors like credit score, revenue, and time in business. Check the requirements first so you don’t waste time or risk dinging your credit by applying for a loan you won’t qualify for.

- Vet the lender: Look for lenders with a strong reputation for customer service – ideally one known for being flexible when hardships come up. You don’t want to end up paying ultra-high interest later.

- Evaluate the loan disbursement speed: In a rush? Prioritize lenders who provide quicker application decisions and fast access to funds.

The 6 Best Types of Beauty Salon Loans

Now that you’re armed with some important background information, it’s time to learn about the different types of beauty salon loans and the benefits they offer.

1. GlossGenius Financing

GlossGenius Financing can help small salon and spa businesses reach their goals. Financing offers range from $1,000 to $250,000 USD, with funds available in as little as two business days if approved.

Try GlossGenius free for 14 days!

What makes GlossGenius Financing special? You just need to be a GlossGenius customer to qualify and process payments with GlossGenius for at least 90 days. And once the financing has been funded, your monthly payment adapts based on salon revenue*. Slower sales cause your payment to go down, which makes staying current on the financing a lot more manageable.

Benefits of Genius Loans

- Fast funding (within two business days)

- No impact to your personal credit rating

- Eligibility based on your GlossGenius payment history

- Pay toward your financing automatically based on your sales*

- Simple fee structure with no compounding interest, collateral, or late fees

2. Small Business Administration Loans

The SBA 7(a) loan program from the Small Business Administration (SBA) gives beauty salons flexible financing options for different needs. Working capital loan? Equipment loan? Funding to invest in real estate? The SBA helps you do it all.

SBA Microloans offer small business loans up to $50,000, making them a great fit for salon owners needing modest capital to purchase equipment or expand services. If you need quick access to funds, SBA Express Loans provide faster approval times so you can act quickly on new opportunities.

Since SBA loans are guaranteed by the government, the rules to qualify are easier than traditional bank loans. That makes this type of funding perfect for salon owners looking to refresh their space, hire more stylists, or take whatever other steps they need to grow.

Getting a loan backed by Uncle Sam means your approval odds go up. You may also get lower interest rates and perks compared to alternatives.

Benefits of SBA Loans

- Can be used for real estate, working capital, or salon equipment financing

- Easier qualifications than traditional loans

- More favorable terms thanks to backing from the government

- Capable of supporting various salon growth and sustainability projects

3. Traditional Bank Loans

Banking has become so digitized that walking into your local branch might feel like stepping back in time. But a traditional bank loan could be just the thing you need to help your business flourish. And don’t let the word “bank” throw you – many credit unions offer small business loans too.

Loans from traditional banks and credit unions typically include options like:

- Commercial real estate loans for purchasing or renovating a salon space

- Business lines of credit to manage cash flow or cover unexpected expenses

- Equipment loans for buying salon tools and equipment

- Construction loans to build or expand your salon

- Refinancing options for consolidating higher-interest debts like business credit card balances or merchant cash advances into a single, lower-interest loan

Benefits of Traditional Bank Loans

- Competitive interest rates and flexible terms

- A variety of loan options to suit different needs

- Local market expertise from experienced lenders

- Support for both growth initiatives and operational costs

4. National Funding Loans

National Funding is a small business funding company that provides customized financing solutions for beauty and wellness businesses. Its lending options – which include small business loans and equipment leasing – aim to help salons and spas cover operating expenses, make payroll, upgrade equipment, and manage staff.

Benefits of National Funding Loans

- Financial services tailored to the beauty and wellness industry

- Options for equipment financing and small business loans

- Quick and easy application process

- Personalized lending solutions based on the specific needs of beauty businesses

5. Merchant Cash Advances

Merchant cash advances (MCAs) provide salon owners with financing based on future sales instead of upfront collateral. You can usually get them from banks or private funding companies. You just pay a fixed percentage of your salon’s daily revenue until the balance is repaid.

The MCA application process focuses on sales trends rather than personal credit scores, making MCAs an accessible option for businesses with less-than-perfect credit. Having your payments tied to a percentage of daily sales could also prove helpful during slower periods.

But proceed with caution – MCAs come with a high cost. Annualized interest rates can range from 30% to 60% or more, which is far above the traditional financing options tied to the prime rate. While MCAs provide quick access to funds, the repayment structure can strain cash flow and create a cycle of dependency if you’re not careful. Avoid this option unless you have strong, predictable sales and a clear plan for managing repayment.

Benefits of Merchant Cash Advances

- Fast access to funds

- Flexible payments

- No upfront collateral required

- Simple application process

GlossGenius now offers MCAs in addition to traditional business loans for all GlossGenius members.

6. Personal Loans for Business

[CTA_MODULE]

Some salon owners use assets like their home or 401(k) account to secure a personal loan, which they then use to self-fund initial startup costs or smaller expansion projects.

Taking on personal debt is riskier and lacks conventional business loan protections. You won’t lose your house if you default on an SBA loan, for example. But if you put up your home as collateral for a personal loan and then fail to pay, the consequences could be life-changing – and not in the good way.

For well-qualified applicants, personal loans can act as short-term financing options for targeted expenses until revenue stabilizes. Just make sure you have a very solid plan in place to repay.

Benefits of Personal Loans

- Not tied to the business

- Flexible depending on your personal assets

Finance Your Beauty Salon With GlossGenius

Ready to launch your salon or give your existing business a boost? Sign up for a 14-day free trial of GlossGenius, the all-in-one salon management platform designed to help you handle scheduling, client records, and business operations without major upfront costs.

Try GlossGenius free for 14 days!

GlossGenius offers easy financing features, with an affordable monthly payment model that makes our salon software accessible to beauty professionals and teams of all sizes. And once you’ve built up a payment history with GlossGenius, it’s super easy to get the fast, flexible financing that will help your business grow.

Stripe Capital offers financing types that include loans and merchant cash advances. All financing applications are subject to review prior to approval. In the US, Stripe Capital loans are issued by Celtic Bank and YouLend provides Stripe Capital merchant cash advances.

*Stripe Capital loans have a minimum amount due each payment period, and if the minimum amount that you pay through sales doesn’t meet the minimum your account will be automatically debited the remaining amount at the end of the period. If your loan has a fixed payment, Stripe stops withholding from your Stripe sales when you meet the fixed payment amount. The payment terms for your offer will be detailed during the application process.

Download Now

.png)

.png)

Join Our Genius Newsletter

Get the latest articles, inspiring how-to’s, and educational workbooks delivered to your inbox.

.webp)