How to Get a Loan for Your Beauty & Wellness Business

Wondering how to get a loan for your salon or other beauty business? Business loans come in many forms, but there are a few key principles to follow.

Wondering how to get a loan for your salon or other beauty business? Business loans come in many forms, but there are a few key principles to follow.

Starting or growing a beauty and wellness business takes more than just talent and passion. It requires funds to buy inventory, rent a location, hire staff, and much more.

Need a lifeline? Business loans can be just what you need to bring your dreams to life. This article will guide you through different types of business loans, how to choose the right one, and tips for getting approved.

Ready to make your beauty and wellness empire a reality? Let's get started with our comprehensive business loans advice for beauty and wellness business owners.

[CTA_MODULE]

3 Types of Business Loans

Before we dive into our business loans advice, we need to talk logistics. Whether you're looking for quick access to cash or a long-term investment to expand your operations, the right loan can help you take the next step.

1. Small Business Administration (SBA) Loans

SBA loans are a great option for beauty and wellness businesses. These loans come with lower interest rates and more favorable terms than traditional bank loans.

One of the best parts is that the government backs these loans, reducing the risk for lenders and making it easier for you to get approved.

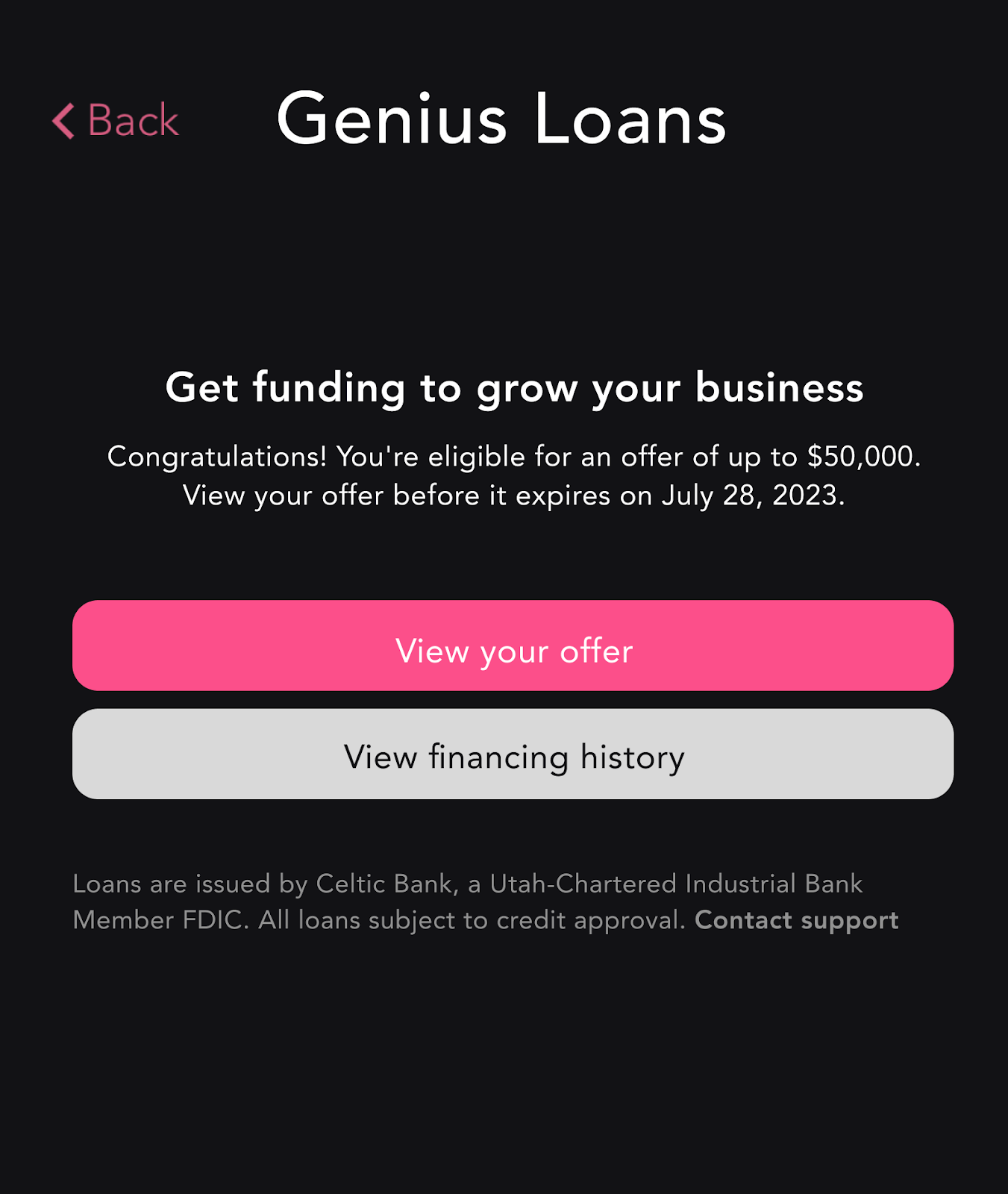

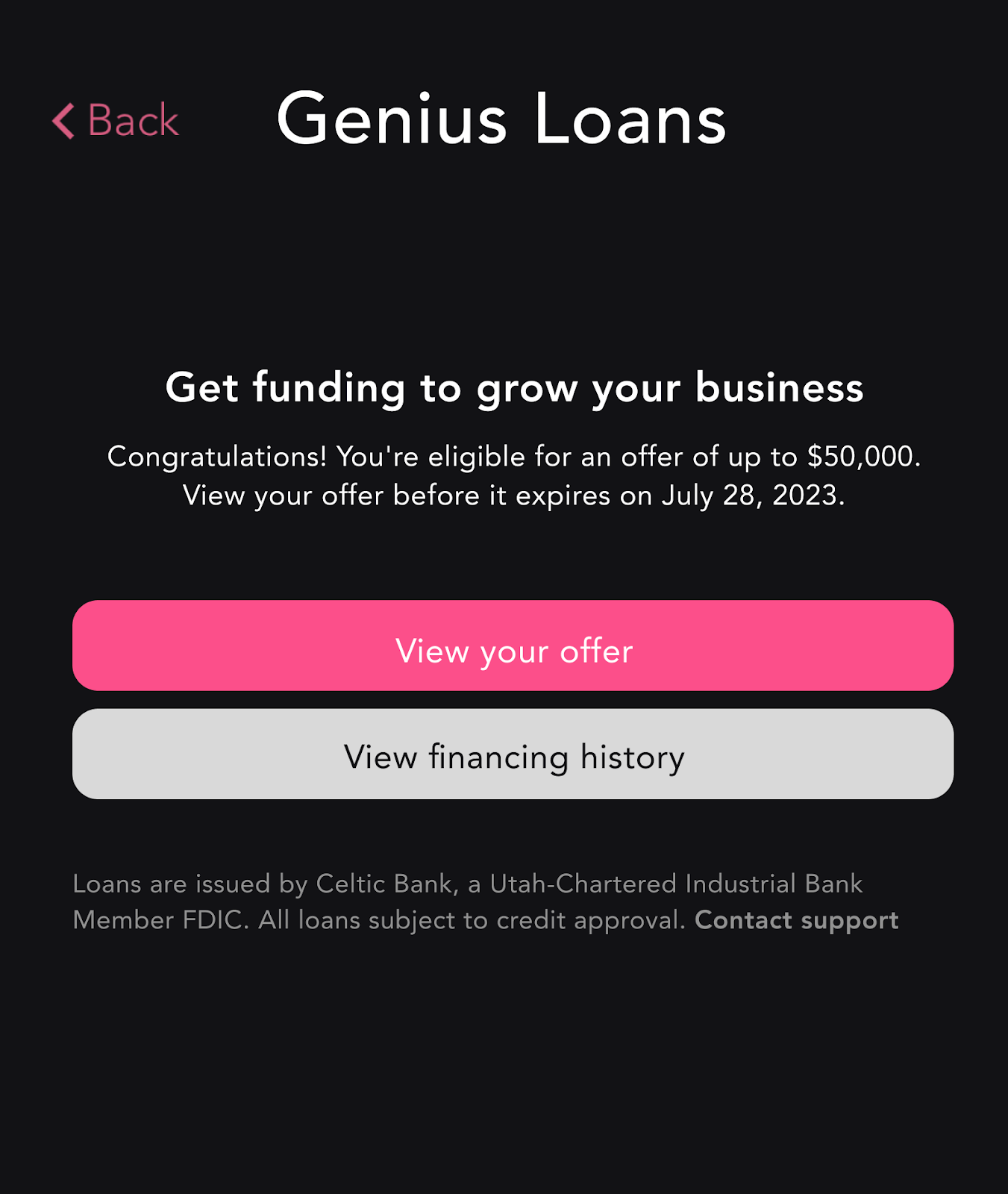

Learn more about GlossGenius Financing.

2. Merchant Cash Advance (MCA)

An MCA is a type of financing that’s based on your business’s credit card sales. It's like getting an advance on your future earnings. The financing provider gives you a lump sum upfront, which you pay with a percentage of your daily credit card sales. This can be a good option if your business has a steady stream of credit card transactions.

GlossGenius now offers MCAs in addition to traditional business loans for GlossGenius members.

3. Microloans

Microloans are small loans, typically less than $50,000. They are perfect for startups and small businesses that need a smaller amount of capital.

These loans are often offered by nonprofit organizations and come with favorable terms. Plus, they usually include support and resources to help you succeed.

How to Choose the Right Loan for Your Small Beauty & Wellness Business

Choosing the right loan is just as important as getting approved for one. Here are a few factors to consider:

1. Financial Health

First things first, you need to assess your beauty and wellness business's financial health. Look at your revenue, profitability, and cash flow. Lenders will also scrutinize these metrics, so it's crucial to have a clear understanding.

If your finances are in good shape, you'll have a better chance of getting approved for a loan with favorable terms.

One of the best business loan tips? If you aren’t sure where your business stands in terms of its financial health, meet with a financial advisor. They’ll help you make some meaning from your financial statements and documents. They can also give you small business financing advice beyond just loans.

2. Purpose of the Loan

Another important piece of small business financing advice is to think about what you need the loan for. Are you planning to purchase new equipment, hire more staff, or rent a larger space? Knowing the purpose of the loan will help you determine the amount you need and the best type of loan for your situation.

3. Interest Rate

Interest rates can make or break your loan experience. A lower interest rate means you'll pay less over the life of the loan. Compare rates from different lenders and consider the total cost of the loan, not just the monthly payment.

Sometimes, a loan with a slightly higher interest rate but better terms can be a better deal in the long run.

4. Repayment Terms

One of the most important pieces of business loans advice is to consider the repayment terms. Some loans offer flexible repayment options, while others may have strict schedules. Make sure you choose a loan with terms that fit your business’s cash flow and financial projections.

How to Get a Business Loan in 6 Steps

Navigating the loan application process can feel daunting, but breaking it down into small, manageable baby steps may help set your mind at ease.

Wondering how to get approved for a business loan? Here’s what you need to do.

Step 1: Improve Your Credit Score and Check Your Credit Report

Before applying for a loan, take a close look at your credit report. Lenders use this information to determine your creditworthiness – and while it’s not the only factor, it’s one of the most important elements to consider when thinking about how to get approved for a business loan.

If your score is less than stellar, don't panic. Paying off debts and ensuring timely payments can help boost your score.

Remember, taking the time to regularly monitor your credit report helps catch errors that might be dragging down your score. Addressing these discrepancies can give you an edge when applying for loans.

Step 2: Gather Necessary Documentation

Lenders love paperwork. To prepare, gather essential documents such as financial statements, tax returns, and business licenses. Having these on hand will speed up the application process.

Make sure your documents are up-to-date and accurately reflect your business’s financial health. This transparency helps build trust with potential lenders – one of the most overlooked business loan tips.

Step 3: Investigate Different Lenders

Not all lenders are created equal. Traditional banks, online lenders, and credit unions offer various loan products. Research each to find the one that best fits your business needs.

Some lenders specialize in small businesses, offering more flexible terms and conditions. Look for those with specific experience in the beauty and wellness sector.

Step 4: Consider Which Loan Type Suits Your Business

Short-term loans, equipment financing, and lines of credit are just a few options available. Each loan type has its benefits and drawbacks. Choose one that aligns with your business goals.

For instance, if you need to purchase new salon chairs, equipment financing might be your best bet. If you're looking to cover operational costs, a short-term loan might be more suitable.

Step 5: Develop a Solid Business Plan

A well-crafted business plan can make or break your loan application. It should articulate your business's vision, mission, and objectives. Detail how you plan to use the loan and your strategy for repayment.

Include market analysis and financial projections to show lenders you mean business. This extra effort can set you apart from other applicants.

Step 6: Submit Your Loan Application

Once you've gathered all the necessary documents and completed your business plan, it's time to submit your application. Double check everything for accuracy to avoid delays.

Even after the ink has dried on your application, make sure you keep communication lines open with your lender. By responding promptly to their questions and requests for more information, you can speed up the approval process and help your business get the money it needs – faster.

[CTA_MODULE]

4 Tips to Get a Loan Approval

Need more advice? Here’s advice on the best way to get a small business loan:

1. Begin the Application Process Well in Advance

The best way to get a small business loan is to prepare, prepare, prepare. Rushing through a loan application is never a good idea. Start the process early to give yourself ample time to gather documents and address any potential issues.

Starting early also allows for unexpected hurdles. Whether it’s fixing a credit report error or collecting additional documentation, having extra time is always beneficial.

2. Develop a Solid Plan for Your Business

Your business plan should be more than just a document; it should be a testament to your business acumen. Clearly articulate your business’s vision, mission, and objectives.

Highlight your unique selling points and how you plan to stand out in the competitive beauty and wellness industry. Show lenders that you have a roadmap to success.

3. Network With Lenders and Financial Institutions

Building relationships with potential lenders can be advantageous. Attend industry events, workshops, and seminars to network with financial professionals.

Having a personal connection can sometimes make the difference between a yes and a no. People are more likely to support those they know and trust.

4. Consider Having a Trusted Individual Co-sign

Getting a co-signer isn’t the best way to get a small business loan if you have good credit, but if your credit score or financial history is less than ideal, a co-signer can bolster your application. Choose someone with a strong credit background and financial stability.

A co-signer reduces the risk for lenders, making them more likely to approve your loan. Just make sure that both parties understand the responsibilities involved before anyone signs anything!

Scale Your Business With GlossGenius’ Financing

Securing a loan or merchant cash advance is just the beginning. To truly thrive, you need tools that help manage and grow your business. That’s where GlossGenius comes in. With our tailored business financing options, we’ll make sure you get the capital you need to make your business a runaway success.

GlossGenius is an all-in-one solution for beauty and wellness business owners. From Online Booking and finance management to Client Management, we've got you covered. Of course, we’ve got your back with financing, too.

Your beauty and wellness business deserves the best, and we’re here to help you achieve it. Try it for yourself free for 14 days.

Stripe Capital offers financing types that include loans and merchant cash advances. All financing applications are subject to review prior to approval. In the US, Stripe Capital loans are issued by Celtic Bank and YouLend provides Stripe Capital merchant cash advances.

FAQs

Is taking out a business loan a good idea?

If used wisely, a business loan can provide the capital needed for expansion, new equipment, or covering operating costs during slow periods. Just make sure you have a solid plan for repayment and consider grants instead when they’re available.

What credit score is needed for a business loan?

Credit score requirements vary by lender. Generally, a score of 620 or higher is required, but some lenders may offer loans to those with lower scores based on other factors.

What is the difference between a secured and an unsecured loan?

Secured loans require collateral, such as property or equipment, which can be seized if you default. Unsecured loans do not require collateral but typically come with higher interest rates.

What is the typical interest rate for a small business loan?

Interest rates vary widely based on the lender, loan type, and applicant’s creditworthiness. Rates can range from 4% to 30%, but you should always compare rates from multiple lenders to make sure you’re getting the best deal.

How long does it take to get approved for a small business loan?

Traditional banks may take weeks to approve a loan, while online lenders can offer approval within days. Having all your documents in order can speed up the process.

GlossGenius can get you financing within two business days if approved. Sign up today!

.png)

.png)

Join Our Genius Newsletter

Get the latest articles, inspiring how-to’s, and educational workbooks delivered to your inbox.

How to Get a Loan for Your Beauty & Wellness Business

Wondering how to get a loan for your salon or other beauty business? Business loans come in many forms, but there are a few key principles to follow.

Starting or growing a beauty and wellness business takes more than just talent and passion. It requires funds to buy inventory, rent a location, hire staff, and much more.

Need a lifeline? Business loans can be just what you need to bring your dreams to life. This article will guide you through different types of business loans, how to choose the right one, and tips for getting approved.

Ready to make your beauty and wellness empire a reality? Let's get started with our comprehensive business loans advice for beauty and wellness business owners.

[CTA_MODULE]

3 Types of Business Loans

Before we dive into our business loans advice, we need to talk logistics. Whether you're looking for quick access to cash or a long-term investment to expand your operations, the right loan can help you take the next step.

1. Small Business Administration (SBA) Loans

SBA loans are a great option for beauty and wellness businesses. These loans come with lower interest rates and more favorable terms than traditional bank loans.

One of the best parts is that the government backs these loans, reducing the risk for lenders and making it easier for you to get approved.

Learn more about GlossGenius Financing.

2. Merchant Cash Advance (MCA)

An MCA is a type of financing that’s based on your business’s credit card sales. It's like getting an advance on your future earnings. The financing provider gives you a lump sum upfront, which you pay with a percentage of your daily credit card sales. This can be a good option if your business has a steady stream of credit card transactions.

GlossGenius now offers MCAs in addition to traditional business loans for GlossGenius members.

3. Microloans

Microloans are small loans, typically less than $50,000. They are perfect for startups and small businesses that need a smaller amount of capital.

These loans are often offered by nonprofit organizations and come with favorable terms. Plus, they usually include support and resources to help you succeed.

How to Choose the Right Loan for Your Small Beauty & Wellness Business

Choosing the right loan is just as important as getting approved for one. Here are a few factors to consider:

1. Financial Health

First things first, you need to assess your beauty and wellness business's financial health. Look at your revenue, profitability, and cash flow. Lenders will also scrutinize these metrics, so it's crucial to have a clear understanding.

If your finances are in good shape, you'll have a better chance of getting approved for a loan with favorable terms.

One of the best business loan tips? If you aren’t sure where your business stands in terms of its financial health, meet with a financial advisor. They’ll help you make some meaning from your financial statements and documents. They can also give you small business financing advice beyond just loans.

2. Purpose of the Loan

Another important piece of small business financing advice is to think about what you need the loan for. Are you planning to purchase new equipment, hire more staff, or rent a larger space? Knowing the purpose of the loan will help you determine the amount you need and the best type of loan for your situation.

3. Interest Rate

Interest rates can make or break your loan experience. A lower interest rate means you'll pay less over the life of the loan. Compare rates from different lenders and consider the total cost of the loan, not just the monthly payment.

Sometimes, a loan with a slightly higher interest rate but better terms can be a better deal in the long run.

4. Repayment Terms

One of the most important pieces of business loans advice is to consider the repayment terms. Some loans offer flexible repayment options, while others may have strict schedules. Make sure you choose a loan with terms that fit your business’s cash flow and financial projections.

How to Get a Business Loan in 6 Steps

Navigating the loan application process can feel daunting, but breaking it down into small, manageable baby steps may help set your mind at ease.

Wondering how to get approved for a business loan? Here’s what you need to do.

Step 1: Improve Your Credit Score and Check Your Credit Report

Before applying for a loan, take a close look at your credit report. Lenders use this information to determine your creditworthiness – and while it’s not the only factor, it’s one of the most important elements to consider when thinking about how to get approved for a business loan.

If your score is less than stellar, don't panic. Paying off debts and ensuring timely payments can help boost your score.

Remember, taking the time to regularly monitor your credit report helps catch errors that might be dragging down your score. Addressing these discrepancies can give you an edge when applying for loans.

Step 2: Gather Necessary Documentation

Lenders love paperwork. To prepare, gather essential documents such as financial statements, tax returns, and business licenses. Having these on hand will speed up the application process.

Make sure your documents are up-to-date and accurately reflect your business’s financial health. This transparency helps build trust with potential lenders – one of the most overlooked business loan tips.

Step 3: Investigate Different Lenders

Not all lenders are created equal. Traditional banks, online lenders, and credit unions offer various loan products. Research each to find the one that best fits your business needs.

Some lenders specialize in small businesses, offering more flexible terms and conditions. Look for those with specific experience in the beauty and wellness sector.

Step 4: Consider Which Loan Type Suits Your Business

Short-term loans, equipment financing, and lines of credit are just a few options available. Each loan type has its benefits and drawbacks. Choose one that aligns with your business goals.

For instance, if you need to purchase new salon chairs, equipment financing might be your best bet. If you're looking to cover operational costs, a short-term loan might be more suitable.

Step 5: Develop a Solid Business Plan

A well-crafted business plan can make or break your loan application. It should articulate your business's vision, mission, and objectives. Detail how you plan to use the loan and your strategy for repayment.

Include market analysis and financial projections to show lenders you mean business. This extra effort can set you apart from other applicants.

Step 6: Submit Your Loan Application

Once you've gathered all the necessary documents and completed your business plan, it's time to submit your application. Double check everything for accuracy to avoid delays.

Even after the ink has dried on your application, make sure you keep communication lines open with your lender. By responding promptly to their questions and requests for more information, you can speed up the approval process and help your business get the money it needs – faster.

[CTA_MODULE]

4 Tips to Get a Loan Approval

Need more advice? Here’s advice on the best way to get a small business loan:

1. Begin the Application Process Well in Advance

The best way to get a small business loan is to prepare, prepare, prepare. Rushing through a loan application is never a good idea. Start the process early to give yourself ample time to gather documents and address any potential issues.

Starting early also allows for unexpected hurdles. Whether it’s fixing a credit report error or collecting additional documentation, having extra time is always beneficial.

2. Develop a Solid Plan for Your Business

Your business plan should be more than just a document; it should be a testament to your business acumen. Clearly articulate your business’s vision, mission, and objectives.

Highlight your unique selling points and how you plan to stand out in the competitive beauty and wellness industry. Show lenders that you have a roadmap to success.

3. Network With Lenders and Financial Institutions

Building relationships with potential lenders can be advantageous. Attend industry events, workshops, and seminars to network with financial professionals.

Having a personal connection can sometimes make the difference between a yes and a no. People are more likely to support those they know and trust.

4. Consider Having a Trusted Individual Co-sign

Getting a co-signer isn’t the best way to get a small business loan if you have good credit, but if your credit score or financial history is less than ideal, a co-signer can bolster your application. Choose someone with a strong credit background and financial stability.

A co-signer reduces the risk for lenders, making them more likely to approve your loan. Just make sure that both parties understand the responsibilities involved before anyone signs anything!

Scale Your Business With GlossGenius’ Financing

Securing a loan or merchant cash advance is just the beginning. To truly thrive, you need tools that help manage and grow your business. That’s where GlossGenius comes in. With our tailored business financing options, we’ll make sure you get the capital you need to make your business a runaway success.

GlossGenius is an all-in-one solution for beauty and wellness business owners. From Online Booking and finance management to Client Management, we've got you covered. Of course, we’ve got your back with financing, too.

Your beauty and wellness business deserves the best, and we’re here to help you achieve it. Try it for yourself free for 14 days.

Stripe Capital offers financing types that include loans and merchant cash advances. All financing applications are subject to review prior to approval. In the US, Stripe Capital loans are issued by Celtic Bank and YouLend provides Stripe Capital merchant cash advances.

FAQs

Is taking out a business loan a good idea?

If used wisely, a business loan can provide the capital needed for expansion, new equipment, or covering operating costs during slow periods. Just make sure you have a solid plan for repayment and consider grants instead when they’re available.

What credit score is needed for a business loan?

Credit score requirements vary by lender. Generally, a score of 620 or higher is required, but some lenders may offer loans to those with lower scores based on other factors.

What is the difference between a secured and an unsecured loan?

Secured loans require collateral, such as property or equipment, which can be seized if you default. Unsecured loans do not require collateral but typically come with higher interest rates.

What is the typical interest rate for a small business loan?

Interest rates vary widely based on the lender, loan type, and applicant’s creditworthiness. Rates can range from 4% to 30%, but you should always compare rates from multiple lenders to make sure you’re getting the best deal.

How long does it take to get approved for a small business loan?

Traditional banks may take weeks to approve a loan, while online lenders can offer approval within days. Having all your documents in order can speed up the process.

GlossGenius can get you financing within two business days if approved. Sign up today!

Download Now

.png)

.png)

Join Our Genius Newsletter

Get the latest articles, inspiring how-to’s, and educational workbooks delivered to your inbox.