How To Do Payroll Yourself: A Guide for Self-Care Businesses

Discover how to do payroll yourself for your businesses with our step-by-step guide. Simplify your payroll process and save time today.

Discover how to do payroll yourself for your businesses with our step-by-step guide. Simplify your payroll process and save time today.

Key Takeaways

- Running payroll gets your employees paid. It involves calculating gross pay, expenses, tax withholdings, overtime, and more – but navigating the numbers can be complicated without a tax professional or the right accounting software.

- Doing your own payroll can save you money and give you more control over your finances. However, it’s also more prone to errors, which can affect your employees’ finances and result in fines or penalties.

- GlossGenius plans start at $24/mo, with a Payroll software add-on for $40/mo + $6/per employee paid.

[CTA_MODULE]

How Does Payroll Work for Beauty and Wellness Businesses?

Business payroll is the process of compensating your employees for their hard work. It involves several key components: calculating wages, managing taxes, and handling deductions. It’s more than handing staff a wad of cash at the end of the day.

First, you have to know your employees’ total wages, also known as their gross wages. This includes their salaries or hourly rates, plus any commissions and tips. For example, if you run a nail salon, employees might earn an hourly wage plus client tips. Their pay varies according to how much an employee has worked throughout the pay period (usually two weeks or a month) or the tips they earned (if you don’t split them), which means you have to keep accurate records.

Before you can calculate net pay for your employees, you’ll have to subtract any mandatory federal and state taxes from your employees' paychecks (such as FICA tax payments). You also need to subtract any post-tax deductions from your team's payments. These include disability insurance premiums, retirement plan contributions, and union dues – whatever applies to your business operations. For example, if you offer disability insurance as an employer, team members who opt in can choose to have their premiums deducted from their paychecks.

Sign up for a 14-day free trial with GlossGenius!

How to Do Payroll Yourself in 9 Steps

[CTA_MODULE]

While the process does get tricky, you can learn how to run payroll efficiently and accurately with a step-by-step approach. Here's how to do it:

1. Collect employee information

Gather the information you need to pay your employees, like their Social Security numbers, completed W-4s (which tells you how much money to withhold for each person), and any other forms for tax withholdings. The IRS has a list that constantly updates, so check that first.

You should also ask employees to fill direct deposit forms if you plan on setting up automatic deposits into employees' bank accounts.

2. Choose a pay schedule

Decide how often to pay staff. Most businesses choose weekly (52 pay periods per year), bi-weekly (26 pay periods per year), semi-monthly (24 pay periods per year), or monthly (12 pay periods per year).

Choose a frequency that aligns with the type and pace of your business. For example, if you run a busy hair salon, your stylists may prefer getting paid every week rather than every month to better manage their income. But for small businesses, weekly payroll can strain your resources. The bi-weekly approach is popular as a happy medium.

3. Calculate regular and overtime wages

Calculate gross pay – which is how much someone earns before taxes and deductions – for each employee, including any overtime hours. For regular wages, multiply their hourly rate by the number of hours worked. For overtime wages, multiply their overtime hourly rate by the number of overtime hours worked.

For example, a nail technician who works 40 hours a week at $20 per hour earns $800. If they work five overtime hours at $30 per hour, they earn $150 in overtime pay. The employee's gross pay is $950.

4. Withhold federal, state, and local taxes

Use the information from your employees' W-4 and other tax withholding forms to calculate how much to deduct in federal, state, and local taxes. These include Social Security tax, Medicare tax, and federal income tax, which varies according to how much an employee earns and their marital status. State income tax requirements vary. Check with the IRS every year, because the rates change. Keep in mind that you as the employer are responsible for paying into the Federal Unemployment Tax, also known as the FUTA tax. The current rate for 2026 is 6.0% on the first $7,000 paid to each of your employees.

5. Process deductions

Calculate and deduct any additional withholdings from your employees' gross pay, like health insurance premiums and retirement plans. The remaining figure is the employee's net pay, which is how much actually ends up in their pockets.

6. Choose a payment method and process payments

Decide how to pay your team. Two popular ways are direct deposit and checks, but direct deposits are usually more convenient for everyone.

Set up the payments according to your chosen pay schedule. Direct deposits can take a couple of days to reach staff bank accounts, so process the payments in advance to make sure everyone gets their money on time. For each payment, provide proof in the form of a pay stub that breaks down all of the pay and deductions.

7. Record payroll

Keep detailed records of your payroll processing. An easy way to do this is with a spreadsheet, where you can log all of your transactions, but a comprehensive system like GlossGenius does tracking even better. Knowing how much you paid and deducted for each employee is essential for tax reporting and filing, organization, and compliance.

8. File and pay payroll taxes

Small businesses have to calculate payroll taxes and pay them to the IRS monthly or semiweekly. The IRS should tell you when your deadline is, but in most cases, it’s on the 15th of every month.

Paying payroll taxes requires an employer identification number (EIN), which is how the IRS identifies you as an employer. (If you employ anyone, you should already have one of these.)

9. Prepare and distribute end-of-year tax forms

At the end of the year, prepare W-2 forms for your employees and distribute them by the deadline – typically January 31st. These forms tell employees how much they earned and paid in taxes over the year, helping them file their personal taxes accurately and on time.

Alternatives to Doing Payroll Yourself for Your Beauty & Wellness Business

So you don’t want to do payroll yourself – and who can blame you? One small error can lead to a world of frustration, not to mention potential penalties and fines. Here is what else you can do to manage your payroll:

Hire an accountant

Hiring an accountant to handle your payroll can be costly, but it is one of the best alternatives to doing payroll yourself. An accountant helps you figure out exactly which deductions and tax credits your business is entitled to, along with any other ways you can save money. They provide meaningful financial insight into your operations to help you make the right financial decisions. Plus, they can keep your books balanced and your records pristinely documented, all while maintaining compliance with state and federal laws. In some cases, an accountant can also help protect your business in the event of an audit or notice. Some accountants charge extra fees to handle letters from the IRS or state in regards to your quarterly or yearly tax filings.

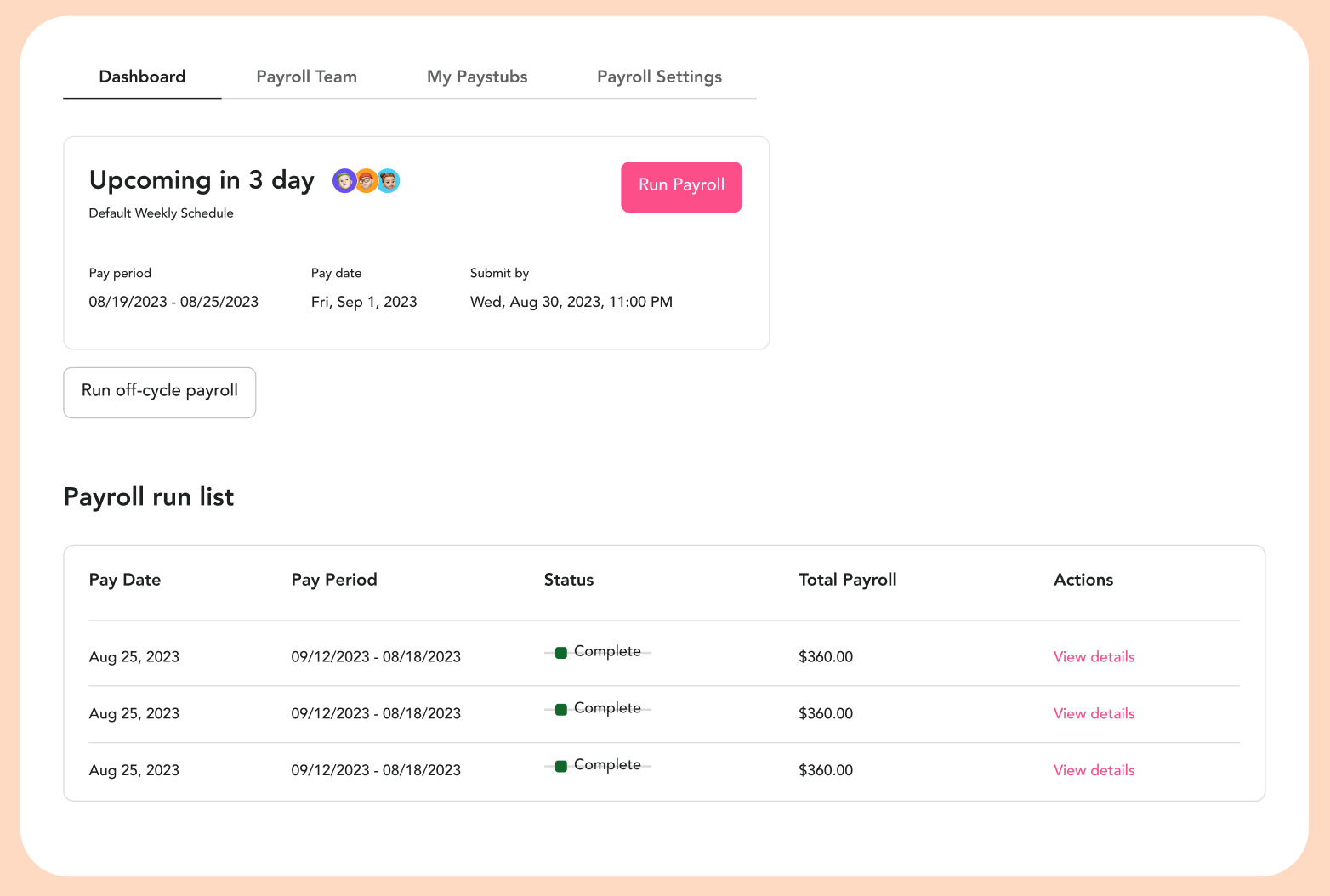

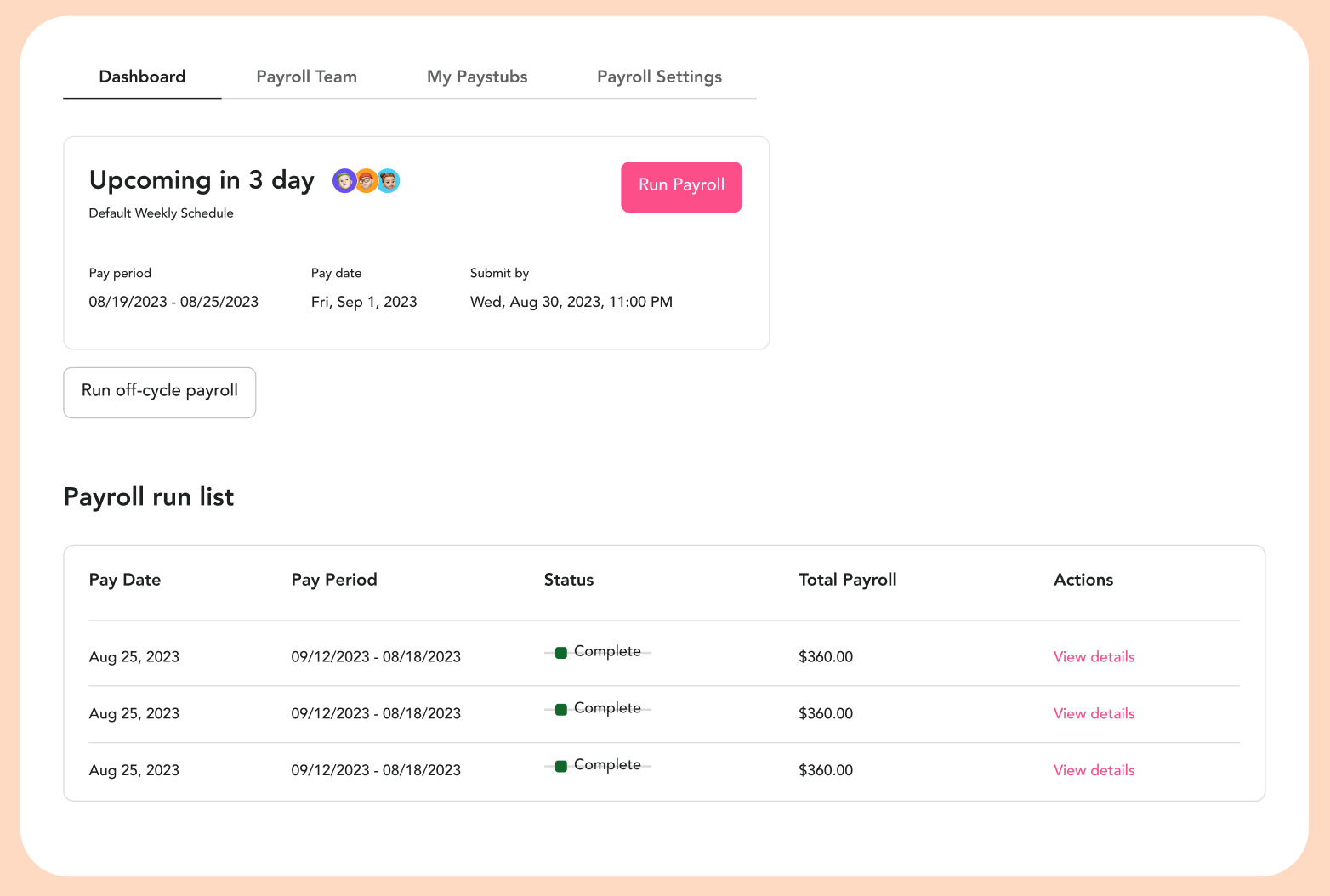

Use payroll software

Investing in payroll software can not only help you cut costs, but manage your payroll with automated features designed to lighten your load. Payroll software features can reduce errors in your bookkeeping, calculate deductions, and streamline the entire payroll process, freeing up more of your time. Some payroll software can track your data in real time for the most accurate financial records, while also keeping in compliance with the latest state and federal laws to ensure you and your employees follow all mandatory guidelines.

GlossGenius is an all-in-one platform for the beauty and wellness industry. With its payroll functionality, you get features like:

- Auto-populating payroll, which automatically syncs appointments, tips, commissions, and hours logged, eliminating manual data entry.

- Full tax support that can calculate and file federal, state, and local payroll taxes automatically in all 50 states.

- Customization features that support unique salon and spa pay structures like service and product commissions, multiple pay rates, and tips.

- Integrated platforms that combine scheduling, payments, reporting, and payroll, all from a single platform.

Try GlossGenius today and manage your Payroll with ease!

Pros and Cons of Learning How to Do Payroll Yourself

As a business owner, taking a DIY approach to managing your finances isn't a decision to take lightly. While in-house payroll can offer big savings and greater control, it also comes with unique challenges. Payroll can be a time suck, and if you aren’t familiar with the process, there’s a whole lot of room for error.

Let's explore two benefits and two drawbacks of doing your own payroll:

Pros

- Potential savings

Saving money is one of the biggest perks of managing financial activities yourself. Hiring an accountant or other service can be costly, and you know as well as we do that every dollar counts when you're operating a small spa or salon. Managing your own payroll system means you can take the funds you'd spend on a professional payroll service and direct them toward essential expenses, like new equipment or ad space.

- Control and oversight

Self-payroll services give you complete control of staff payments. You monitor every step of the process to ensure everything is accurate and stays on track. If something goes wrong, you’re the first to know, and you don’t have to wait for someone at a help desk to jump on the scene.

Cons

- Time-consuming

It’s worth pointing out that running your own payroll can take a lot of time out of your schedule – time that can be spent improving your operations or servicing clients.

All-in-one business management and payroll software like GlossGenius can help you save time with automated tax filing, unlimited runs, and custom tips and commissions on payroll.

- Potential mistakes

There’s a higher chance of making mistakes if you decide to manage payroll yourself. Entering data and calculating taxes can be tricky, especially if you’re not a math whiz. And because you're managing employees' livelihoods, an error can have severe consequences for both their taxes and their lives. Plus, mistakes can throw a huge wrench in your tax process and lead to more ramifications.

For example, the IRS legally requires you to deduct a certain amount from an employee's paycheck for Medicare and Social Security tax. If you fail to do this accurately, you might face fines. On top of that, mistakes can also damage your team’s trust in you.

- Complicated regulations

Keeping up with evolving tax laws and payroll regulations takes time and effort – two resources you don’t always have as a business owner. But if you don't stay up to date, you might miss a change in federal tax rates or another important consideration. You could end up over or underpaying your business taxes, and fixing that problem later on is expensive and stressful.

Simplify Payroll Management With GlossGenius

You and your employees deserve fair compensation – without the hassle. GlossGenius's all-in-one platform makes managing payments a breeze, with affordable pricing plans starting at $24/mo.

In addition to Online Booking, Client Management, Marketing, and POS (with low payment processing rates of 2.6% per transaction), we offer everything you need to run Payroll. GlossGenius Payroll software starts at $40/mo + $6/per employee paid and includes automated tax filing, custom commissions and tips, and no manual data entry. Whether your employees are salaried or hourly, paid monthly or semi-monthly, GlossGenius is here to help with our ultra-customizable system and accessible online payroll system. Plus, it’s easy to transfer your existing payroll information into GlossGenius when you start.

Ready to take payroll to the next level? Start your 14-day free trial today.

This information is provided for general educational purposes only. For legal, cybersecurity or compliance advice specific to your business or situation, please consult a professional.

.png)

.png)

Join Our Genius Newsletter

Get the latest articles, inspiring how-to’s, and educational workbooks delivered to your inbox.

How To Do Payroll Yourself: A Guide for Self-Care Businesses

Discover how to do payroll yourself for your businesses with our step-by-step guide. Simplify your payroll process and save time today.

Key Takeaways

- Running payroll gets your employees paid. It involves calculating gross pay, expenses, tax withholdings, overtime, and more – but navigating the numbers can be complicated without a tax professional or the right accounting software.

- Doing your own payroll can save you money and give you more control over your finances. However, it’s also more prone to errors, which can affect your employees’ finances and result in fines or penalties.

- GlossGenius plans start at $24/mo, with a Payroll software add-on for $40/mo + $6/per employee paid.

[CTA_MODULE]

How Does Payroll Work for Beauty and Wellness Businesses?

Business payroll is the process of compensating your employees for their hard work. It involves several key components: calculating wages, managing taxes, and handling deductions. It’s more than handing staff a wad of cash at the end of the day.

First, you have to know your employees’ total wages, also known as their gross wages. This includes their salaries or hourly rates, plus any commissions and tips. For example, if you run a nail salon, employees might earn an hourly wage plus client tips. Their pay varies according to how much an employee has worked throughout the pay period (usually two weeks or a month) or the tips they earned (if you don’t split them), which means you have to keep accurate records.

Before you can calculate net pay for your employees, you’ll have to subtract any mandatory federal and state taxes from your employees' paychecks (such as FICA tax payments). You also need to subtract any post-tax deductions from your team's payments. These include disability insurance premiums, retirement plan contributions, and union dues – whatever applies to your business operations. For example, if you offer disability insurance as an employer, team members who opt in can choose to have their premiums deducted from their paychecks.

Sign up for a 14-day free trial with GlossGenius!

How to Do Payroll Yourself in 9 Steps

[CTA_MODULE]

While the process does get tricky, you can learn how to run payroll efficiently and accurately with a step-by-step approach. Here's how to do it:

1. Collect employee information

Gather the information you need to pay your employees, like their Social Security numbers, completed W-4s (which tells you how much money to withhold for each person), and any other forms for tax withholdings. The IRS has a list that constantly updates, so check that first.

You should also ask employees to fill direct deposit forms if you plan on setting up automatic deposits into employees' bank accounts.

2. Choose a pay schedule

Decide how often to pay staff. Most businesses choose weekly (52 pay periods per year), bi-weekly (26 pay periods per year), semi-monthly (24 pay periods per year), or monthly (12 pay periods per year).

Choose a frequency that aligns with the type and pace of your business. For example, if you run a busy hair salon, your stylists may prefer getting paid every week rather than every month to better manage their income. But for small businesses, weekly payroll can strain your resources. The bi-weekly approach is popular as a happy medium.

3. Calculate regular and overtime wages

Calculate gross pay – which is how much someone earns before taxes and deductions – for each employee, including any overtime hours. For regular wages, multiply their hourly rate by the number of hours worked. For overtime wages, multiply their overtime hourly rate by the number of overtime hours worked.

For example, a nail technician who works 40 hours a week at $20 per hour earns $800. If they work five overtime hours at $30 per hour, they earn $150 in overtime pay. The employee's gross pay is $950.

4. Withhold federal, state, and local taxes

Use the information from your employees' W-4 and other tax withholding forms to calculate how much to deduct in federal, state, and local taxes. These include Social Security tax, Medicare tax, and federal income tax, which varies according to how much an employee earns and their marital status. State income tax requirements vary. Check with the IRS every year, because the rates change. Keep in mind that you as the employer are responsible for paying into the Federal Unemployment Tax, also known as the FUTA tax. The current rate for 2026 is 6.0% on the first $7,000 paid to each of your employees.

5. Process deductions

Calculate and deduct any additional withholdings from your employees' gross pay, like health insurance premiums and retirement plans. The remaining figure is the employee's net pay, which is how much actually ends up in their pockets.

6. Choose a payment method and process payments

Decide how to pay your team. Two popular ways are direct deposit and checks, but direct deposits are usually more convenient for everyone.

Set up the payments according to your chosen pay schedule. Direct deposits can take a couple of days to reach staff bank accounts, so process the payments in advance to make sure everyone gets their money on time. For each payment, provide proof in the form of a pay stub that breaks down all of the pay and deductions.

7. Record payroll

Keep detailed records of your payroll processing. An easy way to do this is with a spreadsheet, where you can log all of your transactions, but a comprehensive system like GlossGenius does tracking even better. Knowing how much you paid and deducted for each employee is essential for tax reporting and filing, organization, and compliance.

8. File and pay payroll taxes

Small businesses have to calculate payroll taxes and pay them to the IRS monthly or semiweekly. The IRS should tell you when your deadline is, but in most cases, it’s on the 15th of every month.

Paying payroll taxes requires an employer identification number (EIN), which is how the IRS identifies you as an employer. (If you employ anyone, you should already have one of these.)

9. Prepare and distribute end-of-year tax forms

At the end of the year, prepare W-2 forms for your employees and distribute them by the deadline – typically January 31st. These forms tell employees how much they earned and paid in taxes over the year, helping them file their personal taxes accurately and on time.

Alternatives to Doing Payroll Yourself for Your Beauty & Wellness Business

So you don’t want to do payroll yourself – and who can blame you? One small error can lead to a world of frustration, not to mention potential penalties and fines. Here is what else you can do to manage your payroll:

Hire an accountant

Hiring an accountant to handle your payroll can be costly, but it is one of the best alternatives to doing payroll yourself. An accountant helps you figure out exactly which deductions and tax credits your business is entitled to, along with any other ways you can save money. They provide meaningful financial insight into your operations to help you make the right financial decisions. Plus, they can keep your books balanced and your records pristinely documented, all while maintaining compliance with state and federal laws. In some cases, an accountant can also help protect your business in the event of an audit or notice. Some accountants charge extra fees to handle letters from the IRS or state in regards to your quarterly or yearly tax filings.

Use payroll software

Investing in payroll software can not only help you cut costs, but manage your payroll with automated features designed to lighten your load. Payroll software features can reduce errors in your bookkeeping, calculate deductions, and streamline the entire payroll process, freeing up more of your time. Some payroll software can track your data in real time for the most accurate financial records, while also keeping in compliance with the latest state and federal laws to ensure you and your employees follow all mandatory guidelines.

GlossGenius is an all-in-one platform for the beauty and wellness industry. With its payroll functionality, you get features like:

- Auto-populating payroll, which automatically syncs appointments, tips, commissions, and hours logged, eliminating manual data entry.

- Full tax support that can calculate and file federal, state, and local payroll taxes automatically in all 50 states.

- Customization features that support unique salon and spa pay structures like service and product commissions, multiple pay rates, and tips.

- Integrated platforms that combine scheduling, payments, reporting, and payroll, all from a single platform.

Try GlossGenius today and manage your Payroll with ease!

Pros and Cons of Learning How to Do Payroll Yourself

As a business owner, taking a DIY approach to managing your finances isn't a decision to take lightly. While in-house payroll can offer big savings and greater control, it also comes with unique challenges. Payroll can be a time suck, and if you aren’t familiar with the process, there’s a whole lot of room for error.

Let's explore two benefits and two drawbacks of doing your own payroll:

Pros

- Potential savings

Saving money is one of the biggest perks of managing financial activities yourself. Hiring an accountant or other service can be costly, and you know as well as we do that every dollar counts when you're operating a small spa or salon. Managing your own payroll system means you can take the funds you'd spend on a professional payroll service and direct them toward essential expenses, like new equipment or ad space.

- Control and oversight

Self-payroll services give you complete control of staff payments. You monitor every step of the process to ensure everything is accurate and stays on track. If something goes wrong, you’re the first to know, and you don’t have to wait for someone at a help desk to jump on the scene.

Cons

- Time-consuming

It’s worth pointing out that running your own payroll can take a lot of time out of your schedule – time that can be spent improving your operations or servicing clients.

All-in-one business management and payroll software like GlossGenius can help you save time with automated tax filing, unlimited runs, and custom tips and commissions on payroll.

- Potential mistakes

There’s a higher chance of making mistakes if you decide to manage payroll yourself. Entering data and calculating taxes can be tricky, especially if you’re not a math whiz. And because you're managing employees' livelihoods, an error can have severe consequences for both their taxes and their lives. Plus, mistakes can throw a huge wrench in your tax process and lead to more ramifications.

For example, the IRS legally requires you to deduct a certain amount from an employee's paycheck for Medicare and Social Security tax. If you fail to do this accurately, you might face fines. On top of that, mistakes can also damage your team’s trust in you.

- Complicated regulations

Keeping up with evolving tax laws and payroll regulations takes time and effort – two resources you don’t always have as a business owner. But if you don't stay up to date, you might miss a change in federal tax rates or another important consideration. You could end up over or underpaying your business taxes, and fixing that problem later on is expensive and stressful.

Simplify Payroll Management With GlossGenius

You and your employees deserve fair compensation – without the hassle. GlossGenius's all-in-one platform makes managing payments a breeze, with affordable pricing plans starting at $24/mo.

In addition to Online Booking, Client Management, Marketing, and POS (with low payment processing rates of 2.6% per transaction), we offer everything you need to run Payroll. GlossGenius Payroll software starts at $40/mo + $6/per employee paid and includes automated tax filing, custom commissions and tips, and no manual data entry. Whether your employees are salaried or hourly, paid monthly or semi-monthly, GlossGenius is here to help with our ultra-customizable system and accessible online payroll system. Plus, it’s easy to transfer your existing payroll information into GlossGenius when you start.

Ready to take payroll to the next level? Start your 14-day free trial today.

This information is provided for general educational purposes only. For legal, cybersecurity or compliance advice specific to your business or situation, please consult a professional.

Download Now

.png)

.png)

Join Our Genius Newsletter

Get the latest articles, inspiring how-to’s, and educational workbooks delivered to your inbox.